A company’s success is based on whether and to what extent they enrich their shareholders. Shareholders are enriched not just by the operating profits of the company, but also how soundly the financial decision of the company is taken to Create Shareholder Value and increase Company Valuation. The goal of every company should be to Create Shareholder Value. CEOs and CFOs should take keen interest to Measure, Create and Maximize Shareholder Value to meet the expectations of their investors and maximize company growth! Businesses today are therefore needed to practice Shareholder Value Added or Augmented.

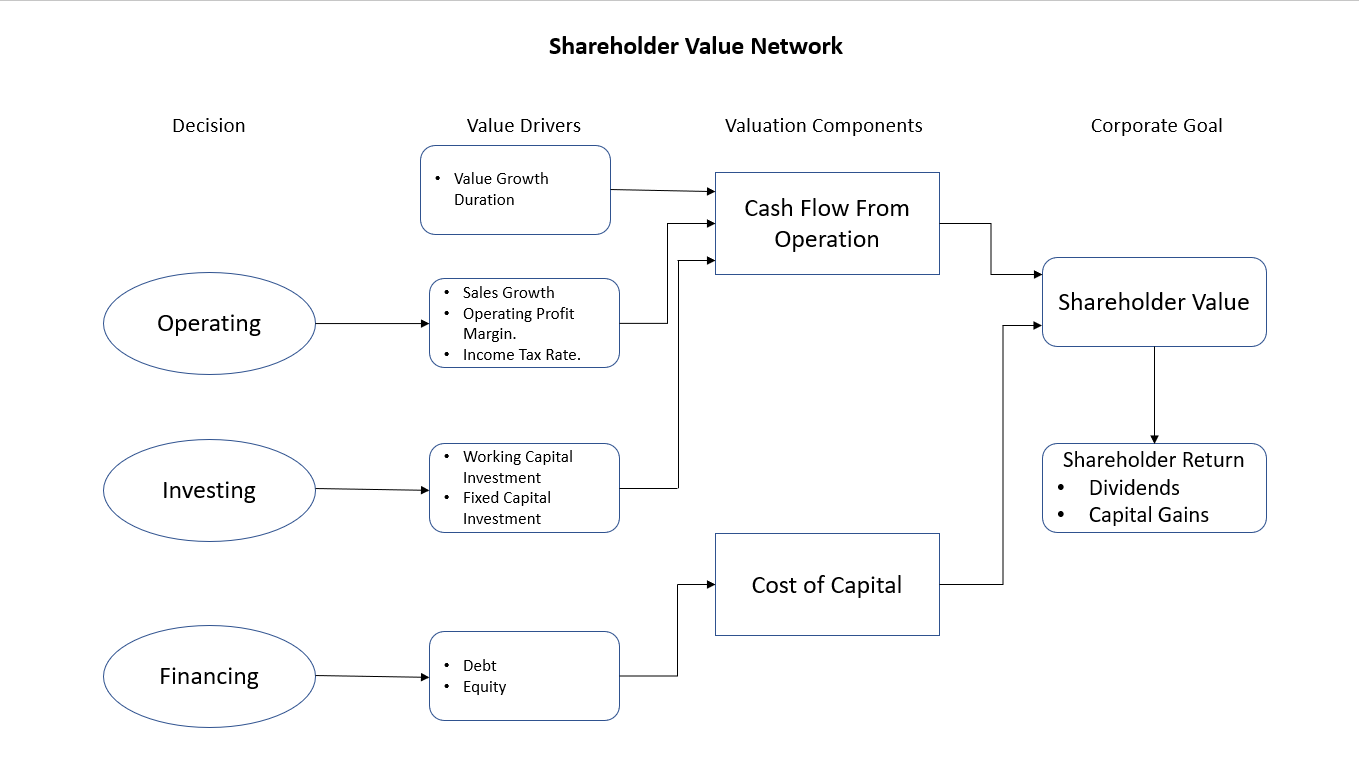

Company Valuation is the process of arriving at the Present Value of a Company through evaluation, estimation, and analysis. It can be best explained by the Shareholder Value Network given below.

Any action indented to increase the Present Value of Business is called Company Valuation Enhancement or Shareholder Value Augmentation (SVAg). In other words, Shareholder Value Augmented (SVAg) addresses the change in value over the Forecast Period. Value Augmentation can happen only if the Investments earn over the Cost of Capital required by the Capital Market. If one looks at the above chart one can understand that any activity undertaken by the Company to:

Improving Sales Growth Rate (assuming it earns above Cost of Capital) will lead to increase in Company Valuation:

- Leveraging Existing Assets like Amazon does by leveraging its existing customer base and add new product categories to increase Sales Growth Rate.

- Investors gave the Marriott Corporation relatively less credit for its rapidly growing hotel management and service businesses because of the hefty debt load. Marriott undertook a Corporate break-up in 1993 and separated the Hotel Management Business from the Real Estate business as they could not pursue growth strategies in the hotel Management business with a low Return On Equity and declining Share Price. Once they separated their ability to make a profit with minimal capital investments increased. Their Return on Equity escalated quickly from 9% to over 20%. With financing aids taken from the market, the company came up with a lot of hotels growing fast in a short time. Marriott grew over 20% annually for a decent period of time in a capital-intensive business. The goal of dividing the company, sources said, was so that the combination of the two companies' stock prices will be higher than Marriott Corp.'s Company Valuation.

Increasing Operating Profit Margins (either through better pricing and or Cost Efficiencies or Divesting in Loss Making Businesses) will lead to improving Margins. Though the Government kept increasing Taxes on Cigarettes, ITC kept increasing Prices. Today it enjoys a 60% OPM against a 30% OPM about 5 Years ago with little volume growth. Zee divested from the loss-making venture - Ten Sports to Sony which lead to improving its Operating Profit Margin.

Reducing Income Tax burden discounts the cost of debt. Apple had huge Cash Overseas and yet raised a Debt. If Apple had chosen to repatriate its cash and liquid assets held overseas using the earlier applicable tax rate, it might have had to shell out taxes at a 35-percent rate. With Apple enjoying a low-risk credit rating, raising funds through bonds is a relatively cheaper option. The economics of the debt work out better for Apple when the earlier 35-percent repatriation tax is taken into consideration. This strategy tends to reduce the Cost of Capital and increase Company Valuation.

Reducing Incremental Fixed and Working Capital Investment Rate brings opportunities for increased profits and expansion. Sam Walton, the founder of Walmart, was famous for the concept of negative working capital. This most often arises when a business generates cash very quickly because it can sell products to its customers before it has to pay the bills to its vendors for the goods delivered. This way the company is effectively using the vendor's money to grow its business.

Walton was a merchandising genius, and he would order huge quantities of merchandise and then have a blowout event around it, to sell the items quickly and use the profits to expand his empire.

Increasing Growth Duration (Forecast Period) builds a competitive edge and company valuation. It is probably the most important aspect of Shareholder Value Augmentation. This can be done through creating long-term competitive advantages where the company can earn above its Cost of Capital for a long duration.

Branding and Distribution like Coca Cola:

- The secret recipe for Coca-Cola makes it the iconic brand that it is. Arguably tasting better than other cola drinks, the recipe is known to only a chosen few who aren’t allowed to board a flight together.

- Their ability to continue developing new products and re-inventing old ones

- The world’s most comprehensive distribution system has made Coca-Cola accessible to billions of people worldwide.

- Coca-Cola’s production techniques are so well developed that it costs a fraction of the selling price to manufacture their product, resulting in high-profit margins.

- Coca-Cola’s marketing techniques create an impression of the brand in the market like none other

- Patents grant a monopoly over the sales of a new drug to its developer or owner for a specific period, which gives firms a limited time during which they can earn bumper profits.

- Superior differentiation and/or lower cost compared to its competition crafts to increase company valuation / economic value. The cost of oil production of Aramco is the lowest across the South West Airlines Business Model which gives it a competitive edge.

Patents

Natural Resources and Superior Differentiation

All of the steps mentioned above drive positive effects on the Future Cash flows, thus increasing Company Valuation in the long-term.